So, I was specifically waiting for the climax of what was happening, although I am completely sure that the most interesting and loud is yet to come 😅 But soon - spot it.

I liked the experience of the last digest, I propose to build this one in a similar way. Let's start with a timeless classic.

Bitcoin

At the beginning of the week, Steve Wozniak from Apple in an interview said that bitcoin is safe, will live for a very long time and will grow to $100,000 in the foreseeable future. True, it is difficult to say what exactly he proceeded from when naming this price, but this is Woz, he can.

The NFT marketplace of the OKX cryptocurrency exchange has posted a collection of bitcoin punks from the Ordinals protocol (detailed in the previous two issues), which can be purchased for ETH or ERC20 tokens. OKX stated that the listed tokens are real NFTs that have been verified by the platform and can be withdrawn to a BTC wallet via EmblemVault.

Meanwhile, the total number of NFTs on the Bitcoin blockchain has surpassed 320,000.

By the end of the week, "grandfather" got tired, but not much - all the same +/- $20k

But I will talk about the reasons a little later.

Regulation

What do you remember about the first 10 days of spring in the field of regulation of cryptocurrencies and the entire industry.

As Janet Yellen reports at the G20 meeting, the IMF prefers regulation to a total ban on cryptocurrencies.

At the same time, one of the important players, the CEO of Coinbase, does not mind and says that “we need a clear set of rules for regulation, since traditional financial companies are increasingly beginning to integrate the blockchain.

But the CEO of Ripple is more pessimistic and says that crypto companies are leaving the US. And it is precisely the uncertainty of their status, among other things, that makes them do it.

The state of Utah decided not to get lost and legalized the DAO on the sly. Decentralized Autonomous Organizations now have full legal status.

In early March, stablecoin issuers, united in the Stablecoin Standard group, announced the start of work on creating a single set of standards that would increase consumer confidence in digital assets. But, as we can see, it did not help them much. Probably should have thought about it earlier.

In turn, Ras Al Khaimah, one of the emirates of the UAE, which is going to open a free zone for crypto companies, is also exploring the possibility of introducing crypto payments for services and services.

Implementation

Let's talk about payment services. Ripple payment technology expands to 6 more countries through partnership with Tranglo!

Bybit will issue a Bybit Card debit card that will operate on the Mastercard network. The already classic crypto-card will be tied to an exchange wallet - when paying for goods and services, the debited digital assets will be automatically converted into fiat.

At the same time, Mastercard and crypto exchange Bitso are launching a debit card in Mexico.

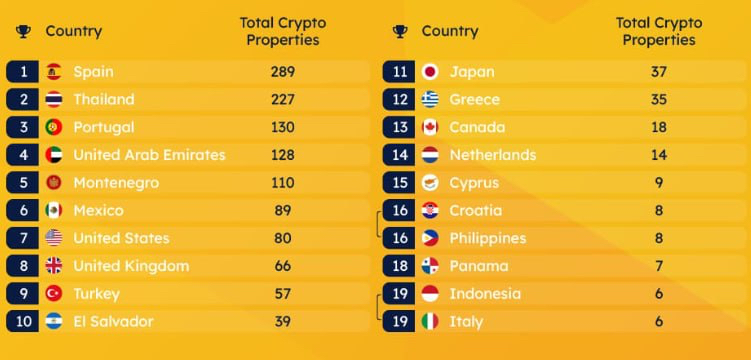

In my opinion, the implementation is much faster than regulation. For example, the number of properties offered for sale for crypto is as follows:

As we see the leaders are Spain, Thailand, Portugal, UAE, Montenegro and Mexico mentioned above.

And the top 5 universities in Britain have begun offering research programs as well as courses on blockchain and cryptocurrencies. At the same time, the Central Bank of England reports a lack of technical skills for issuing CBDC.

Meanwhile, BIS is developing a cross-border retail payment system called CBDC.

The US Treasury will lead a new working group on the digital dollar.

Australia will launch a CBDC pilot in the coming months. At the same time, the introduction of cryptocurrency legislation in Australia can be expected no earlier than 2025, since the government, most likely, does not want to rush to get a complete picture of the nuances of the crypto industry and look at the experience of other countries.

But Iran has already completed the preliminary phase of the CBDC pilot. Such haste is connected with the visit of the head of the Central Bank of the Russian Federation.

The Russian banks included in the pilot group have completed the first stage of testing the digital ruble. Tests passed successfully in February 2023.

In particular, the work of a digital wallet was checked, the purchase of digital rubles, their transfer by phone number, etc.

The Central Bank reports that Russian banks will soon add digital wallets for digital rubles to their applications.

Brazil also reported on the successful pilot launch of the CBDC.

Nubank, a Brazilian digital bank with 70 million users, has also launched its own Nucoin coin, developed by the Polygon project.

And here we are smoothly moving on to the loudest news of the end of this week. Let's talk about stablecoins.

According to Chainalysis, USD-pegged stablecoins are used in many countries to save from inflation and devaluation of local currencies. It is difficult to disagree with this, if not for one BUT.

Look at this data. TrueUSD (TUSD) became the 5th stablecoin in the market cap at the beginning of the week. Binance is minting 130 million TUSD per week!

And over the past weekend, Tether printed another 2,000,000,000 USDT!

I can't get over this fun fact: last year the WSJ published 84 articles about Tether or mentioning the company. And as we remember, the vast majority of them were negative. At the same time, USDT feel quite cheerful, which cannot be said about USDC and DAI.

Now watch your hands:

The collapse of FTX could not help pulling those who were closely enough connected with the company.

January of this year:

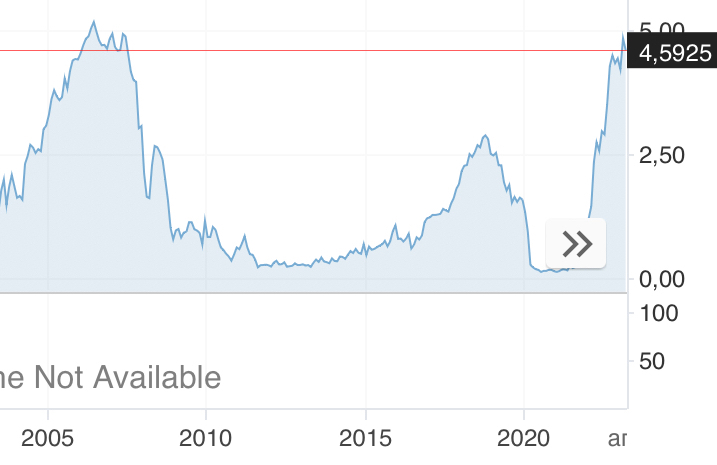

Short interest* in the shares of the Silvergate bank, tightly tied to the crypt, made almost to the Moon in a month.

*The total number or value of shares sold by the people who borrowed them because they expect to buy them back at a lower price in the future and profit from the difference

Meanwhile, Silvergate deposits, also linked to cryptocurrencies, fell 68% to $3.8 billion. The bank suffered a loss of $718 million, sold bonds to raise capital and laid off about 40% of its total staff.

Agencies, albeit reluctantly, begin to lower the rating of the bank. It also appears that, along with Signature Bank (also tied to crypto), both companies were forced to borrow more than $13 billion at the end of 2022 to make up for losses from the massive withdrawal of customers from the cryptocurrency market after the collapse of FTX.

End of January - Silvergate suspends dividends, and US lawmakers and regulators begin to seriously examine the bank's links with Alameda (the same investment company that was literally pumped with money by Sam from FTX).

Early March - despite the fact that many funds, including the Citadel Soros fund, enter Silvergate and the stock price is growing, one of the main US crypto exchanges, Coinbase, parted ways with the bank and transfers clients to Signature Bank.

According to S3 Partners, short interest in Silvergate shares continues to increase and at that time was 82% of free-float *, which makes the stock the most shorted on Wall Street 🤯

*Free-float - part of the company's shares available to private investors who are not related to the issuer itself, issuing these shares and not participating in the strategic control of the enterprise.

March 5 - Silvergate Bank closes its crypto payment service. The day before, the stock fell to an all-time low of 97% from its all-time high in November 2021.

On March 8, Silvergate is negotiating with FDIC representatives about ways to save the bank, but all in vain. The next day, Silvergate winds down operations and liquidates its bank. It is reported that all deposits will be fully repaid.

And it seems like you could exhale, but no. Representatives of JP Morgan are beginning to escalate that after the closure of Silvergate, the main focus will be on the actions of Signature Bank and the Binance crypto exchange. Regulation will tighten, and inflows into the crypto space will slow down and decrease amid restrictions on the work of banks with crypto.

At the same time, on the same day, the yield on two-year US bonds exceeded 5% for the first time since 2007.

Let’s continue to follow the hands.

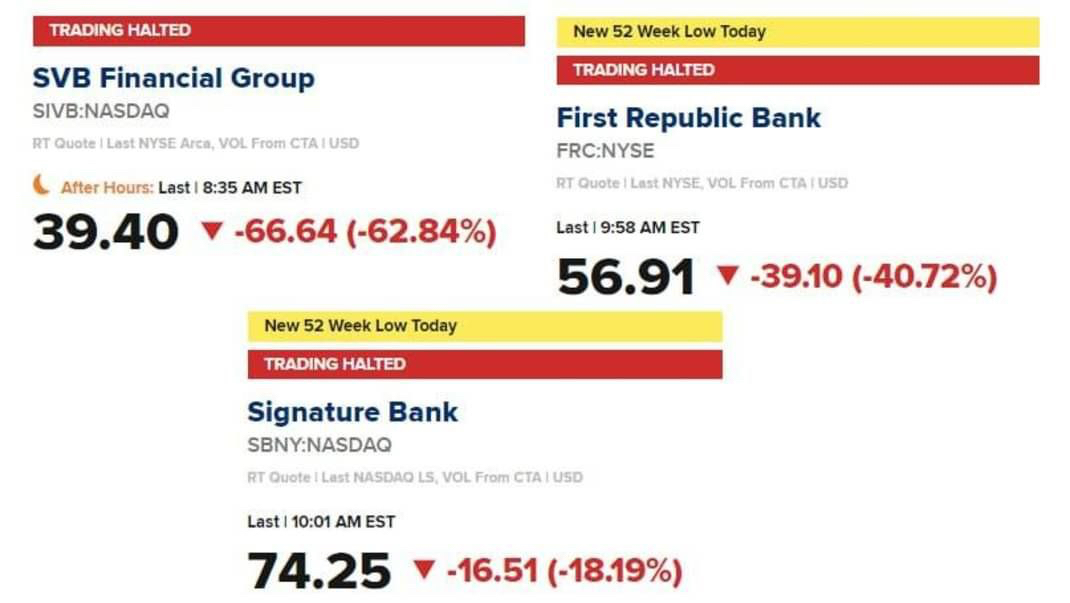

This week, Silicon Valley Bank announces the sale of $2.25 billion of its own shares to cover a $1.8 billion loss. It is said to be the largest bank failure in the US since 2008.

It is worth noting that this is the 16th largest bank in the US, with a large focus on startups and venture capital funds. And most importantly, not on the classic ones, but also tied to the crypt.

And just yesterday, the bank's shares fell by almost 70%!

Michael Burry tweets that it looks like we will have a new Enron. Those who are familiar with the "Harry Potter and the Magic Bubble" digest will be able to fully understand the doctor's humor.

By evening, CNBC reports that the Silicon Valley bank failed to raise capital. The bank hires a consultant for the sale. And here is the result - the California regulator closes Silicon Valley Bank. This is the first FDIC insured bank to fail in 2 years.

Also in the United States stopped trading in the shares of two more banks. I already spoke about Signature above.

By the way, SVB CEO Greg Becker sold $3.6 million worth of shares in the company less than two weeks before the bank went bankrupt.

In fact, the collapse of Silicon Valley Bank is associated with high rates in the US and the accumulation of losses from holding US Treasuries and other bonds. Clients were withdrawing deposits, and SVB began to experience a shortage of capital. However, you already know what happened next.

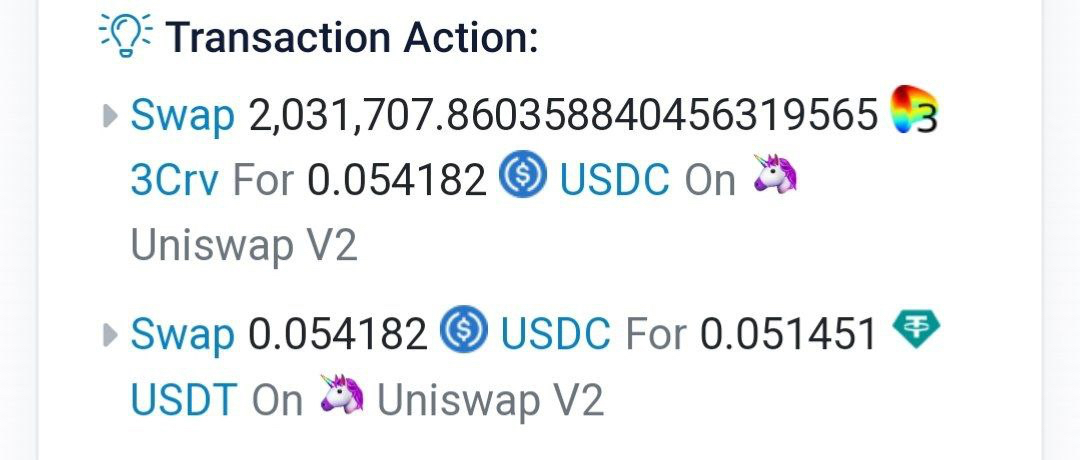

And that's exactly why I described it. Issuer USDC Circle has announced that it is holding $3.3 billion in reserves at the most bankrupt Silicon Valley Bank.

Naturally, the USDC stablecoin lost its peg to the US dollar and traded below $0.9.

In a panic, one trader even exchanged 2 million USDC stablecoin at the rate of - USDC dollar for 5 cents USDT due to lack of liquidity in the Uniswap v2 pool. So he lost 95% of his fortune.

Do you think the domino effect is over? No matter how! Algorithmic stablecoins DAI and FRAX lost their peg to the US dollar following USDC. The latter makes up a significant share of their collateral 🤯

But let's not talk about sad things and end this digest with positive news.

For example, China has unveiled a comprehensive plan to promote the country's digital development.

At the same time, China's investments in US Treasuries fell by $173.2 billion (-17%) in 2022 and reached $862.3 billion, the lowest level since May 2010.

Japan, on the contrary, again purchased US government bonds. Let me remind you that the country is the largest "whale" in US government bonds over the past 2 years.

In turn, Fujitsu and Mitsubishi plan to create a Japanese "Metaverse Economic Zone".

Web3

Lego has partnered with Epic Games. The companies plan to expand their presence in the metaverses.

Remember last time I talked about the Playboy meta? Brazzers is not far behind and plans to launch its metaverse in the fall of 2023.

Rapper Snoop Dogg (also known in the crypto community as Cozomo de' Medici) has co-founded the Web3 streaming platform Schiller, which is scheduled to launch in April this year.

Shiller is designed to combine online broadcasts with Web3 technologies - it will allow content authors to create their own tokens and digital passes.

Snoop Dogg also partnered with the Roobet crypto casino. Will hold the position of CGO (Chief Ganjaroo Officer) 😅