Results of the last decade of March. The digest is built in a familiar format.

Bitcoin

As we already know from the “Skin in the Game” digest, the US government is one of the largest bitcoin holders. Since 2020, the US authorities have confiscated over 200 thousand BTC worth more than $5.5 billion (depending on the exchange rate 😅).

It became known that in 2023 50,000 bitcoins will be sold, which were confiscated from the Silk Road darknet marketplace (including what was taken from hackers). The first of five sales of 9,800 BTC was made on March 14th.

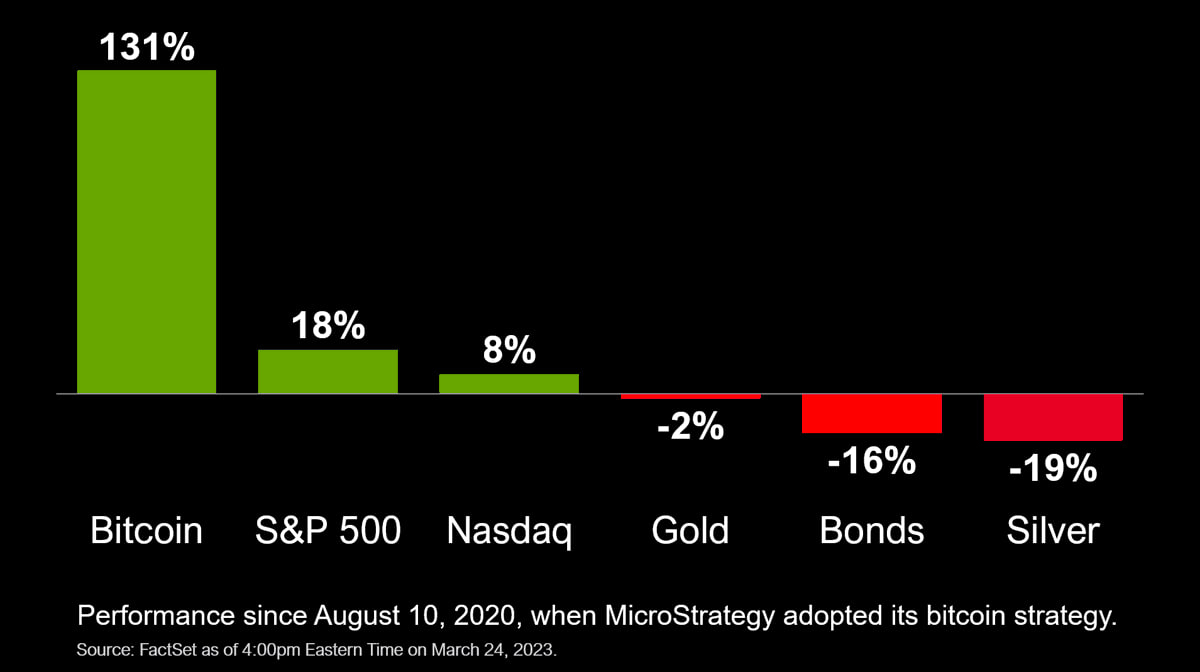

Another well-known "whale", Michael Sailor, demonstrated how Bitcoin behaves relative to the most popular assets. It dates back to August 10, 2020, from the moment MicroStrategy adopted the BTC strategy.

But the company is not going to stop there. The CEO of MicroStrategy announced the purchase of 6455 BTC for about $150 million.

At the moment, the amount of digital gold at the disposal of MS has reached 138,955 coins.

In turn, the guys from the IIF (The Institute of International Finance) expressed quite an interesting idea: “BTC rose not because it is a safe haven from banks, as many now believe, but because the markets began to bet on monetary policy softening. There is absolutely nothing unique about how BTC is traded. It's just another asset bubble that rises and falls with the actions of the Fed…”

At the same time, if someone after such words has already decided that he invested in 💩 - do not despair. History especially for you. Tom Campbell, a farmer from good old Ireland, has found a way to use livestock waste to mine bitcoin. It decomposes the manure to such an extent that methane begins to be released from it, with the help of which it is possible to generate electricity.

The Irish government estimates that if 41% of farmers start using Campbell's green electricity technology, they could generate enough power to power all of the country's residential infrastructure.

Such high-tech news is well complemented by the following. The ZeroSync organization intends to use zero-knowledge proof (zk) technology to scale Bitcoin.

The solution will allow you to quickly synchronize with the blockchain of the first cryptocurrency without the need to download the full amount of data (I was recently interested - it's almost 1/2 TB 😳), but only a part.

ZeroSync emphasized that ZKP is widely used in various iterations by second-tier networks for scaling Ethereum (Polygon, Arbitrum, Optimism and StarkNet). However, the Swiss project has become a pioneer in the implementation of such a protocol in bitcoin!

Implementation

The WSJ reports that following Hong Kong's approval of bitcoin retail, over 20 crypto companies have announced plans to open branches in the region, with another 80 expressing interest in doing so. As I have repeatedly said in past digests, the situation is more than favorable for Hong Kong to become a global crypto hub with clear goals and logical regulation.

China will also update national blockchain standards by 2025, according to the Ministry of Industry and Information Technology of China.

The German bank Dwpbank will offer its cryptocurrency trading platform to more than 1,200 of its affiliated banks and other clients.

Nasdaq plans to launch a cryptocurrency custody platform aimed at institutional investors by the end of the second quarter of this year.

It is quite predictable and reasonable that the exchange will first focus on storing BTC and ETH.

At the same time, according to the Associated Press, Americans' confidence in classic banks has fallen significantly (which is never surprising, judging by the events of the last 15 years at least). Only 10% of US adults rated their level of trust in banks and other financial institutions as high.

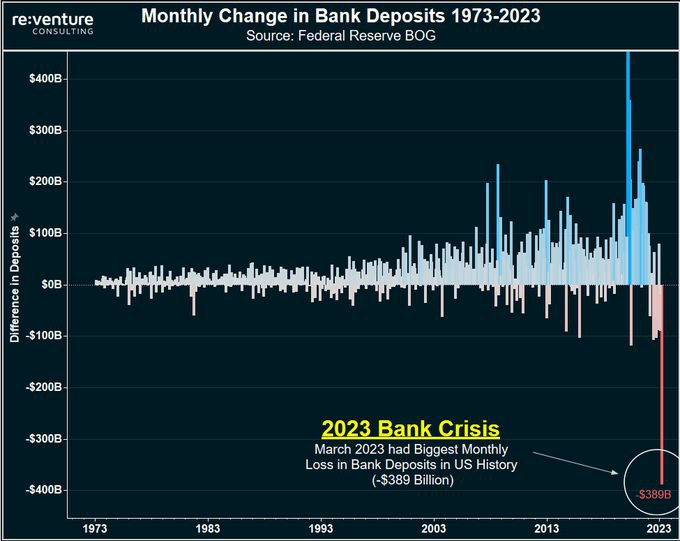

This statement is illustrated by the fact that US banks lost almost $400 billion in deposits in March. This is the largest monthly loss in US history. In the chart below, you can see the period literally since the decoupling of the US dollar from gold in 1971 👇🏻

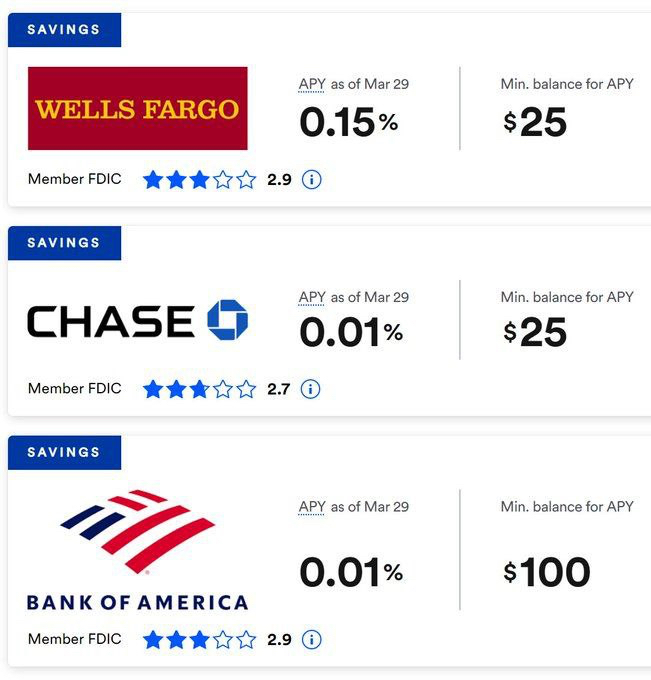

So that you understand the context - here is the level of diversity of profitable deposits in the USA (in the image of the 3 largest banks in America)

The head of the fourth largest bank in America, Citi, said that it was mobile applications that accelerated the collapse of banks. In her opinion, customers can instantly transfer significant amounts from their gadgets, and this "changes the rules of the game."

Meanwhile, Western Union branches throughout Argentina ran out of cash dollars. For several days now, people have been standing in long queues for several hours, trying to receive currency transfers.

Due to the high inflation of the Argentine peso (about 100% per year, more about this in the "GAME CRYPTO + CHAMPIONS" digest), local residents prefer to keep all their savings in dollars or cryptocurrency.

But Latin America's largest giant, Mercado Libre, now allows users in Chile to trade cryptocurrencies through its app.

In England, on the contrary, the mood is more conservative, there were protests against the introduction of the digital currency of the Central Bank. At the same time, the British Burger King says that "they need DOGE."

Also, Burger King now allows customers to pay with cryptocurrencies in their establishments in Paris.

BK also installed the popular Instpower external battery rental machines, which, in addition to traditional payment methods, accept cryptocurrency through Alchemy Pay and Binance Pay.

Regulation

Despite the news from BK above, the French National Assembly voted to ban the promotion of cryptocurrencies. The law only allows advertising if the crypto service provider has a PSAN license, which no one else has.

Also last week, EU lawmakers voted to ban anonymous transfers from crypto wallets above €1,000.

And some Binance staff and volunteers provide advice to users in China and other countries on how to avoid KYC checks. It is reported by CNBC with reference to Chinese-language chats controlled by the trading platform.

As I have repeatedly emphasized in past digests, CZ cannot escape the fact that very soon they will begin to play the card of its cooperation with the Celestial Empire at full speed. Even if this cooperation is due only to the fact of Zhao's birthplace.

And now the story is actively dispersed that Binance has been hiding significant ties with China for several years. And this allegedly contradicts the management’s claims that the crypto exchange left the country after the repression in the industry at the end of 2017.

However, no one is interested in who is theirs and who is a stranger. I have already described the situation with classical banking in the USA above. And the head of the SEC, Gensler, said that there is no need to come up with separate rules and regulation for the crypt - it is perfectly regulated by existing US securities laws.

At the same time, it became known that Henry will first speak before the House Financial Services Committee on the topic of crypto regulation in 2 weeks - on April 18.

After receiving notification from the SEC, Coinbase CEO calls for the election of legislators who support the crypto. Ironically, last week during the course of the Bankman-Fried criminal case, it turned out that he was "feeding" not only the US Democratic Party, but also officials from China.

Web3

Jack Ma has returned to China itself, and Alibaba Cloud reports that it is opening a blockchain lab for game developers in Japan.

Fashion house Gucci has partnered with Yuga Labs, the studio behind NFT BAYC. As part of the collaboration, branded digital items will appear in the Otherside metaverse.

The Walt Disney Company, on the other hand, has shut down its metaverse division. The department has about 50 staff and almost all of them will be subject to layoffs as part of the global layoffs.

Mickey intends to reduce his operating expenses by $5.5 billion, and for this he only needs to lay off 7,000 employees within two months.

Ledger, on the contrary, raised $100 million in the next round of funding. The company is now valued at €1.3 billion. At the moment, users store more than 20% of all crypto in the world and more than 30% of all NFTs in the world in the most modern wallets. (More about Ledger in "Back to the CryptoFuture")

Not far behind the King of Burgers and Papa Johns. A well-known pizzeria is launching an NFT collection on OneRare, a metaverse of the global food and beverage industry that allows diners to walk around virtual restaurants and exchange NFTs for real meals.

And finally, of course, about 🍻 Tesla has released GigaBier branded beer. A package of three bottles of 0.33 ml costs €89 on the company's website. Just look at the design of the bottles.

Elon Musk also decided to earn extra money as a designer on Twitter. The social network logo has changed from the classic bird to the DOGE logo. The coin, like a trained dog, immediately made + 10%. At the same time, lawyers for the dog father and the companies owned by him called the claims for $ 258 billion from the investor Dogecoin literally "a bizarre fiction."