A group of 24 Chinese scientists at the end of December published a sensational scientific article claiming to have found a method to crack the most popular online encryption algorithm RSA-2048 using current generation quantum computers!

If the statements are correct, then the discovery is made many years earlier than expected by the scientific community.

What to read? I highly recommend Roger Grimes' Cryptography Apocalypse.

The race for quantum supremacy is as fundamental a rivalry in the information age as the race for strong AI. More on that later, for now, just keep this statement in mind.

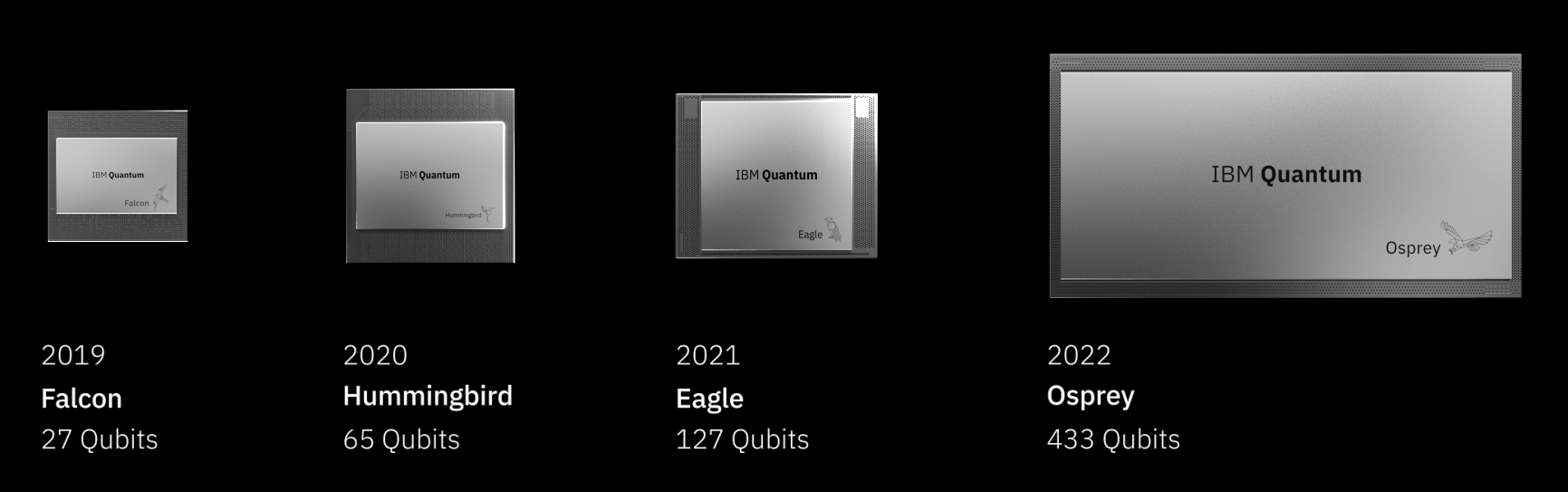

As I said in last year's releases, IBM announced the launch of the world's most powerful 433-qubit quantum computer Osprey at the beginning of 2023. The Chinese claim the ability to crack online encryption on 372 qubits! It's getting really hot!

Meanwhile, China continues to believe in timeless classics and actively buys gold for reserves for the second month in a row! At the same time, prices for it for the first time since May exceeded $1,900 per troy ounce.

An interesting parallel - for 10 such ounces you can buy only 1 bitcoin, its price this week exceeded $19,000 (at the time of this writing, it even exceeded 21 thousand)! It is also interesting that according to the SFC, the illiquid supply of BTC has reached a record 15 million coins out of a total issue of 21 million. These are BTC, which are now out of stock exchanges, most of them are on cold wallets and are not traded.

Returning to microelectronics, it is worth noting that sales of semiconductors in China fell by 21% in November, as global demand for classic chips continues to decline for the third month in a row.

At the same time, I would like to draw your attention to an interesting report by the Washington-based CSIS (Center for Strategic and International Studies) on US attempts to drag the semiconductor industry from Taiwan.

According to him, factories can be built, and the Biden administration is feverishly doing it right now. But an extremely funny situation arises - there is no one to work at these factories.

The shortage of skilled labor for the industry is estimated at 300,000 people. The reason, which is not mentioned in the report, is reform, more precisely, commercialization, of education. No graduates, no students, no teachers, no equipment.

I'm not hinting at anything, but perhaps that is why there is a certain pause in the confrontation between the United States and China over Taiwan. According to experts, the implementation of the military scenario in the Pacific Ocean would be fraught with huge losses for both sides, which they do not want.

The United States began to replenish the strategic reserve of uranium.

At the same time, the United States, Canada and Mexico will jointly seek markets for pure hydrogen, develop the semiconductor industry, and also create a committee that will deal with import substitution for North America.

All this, of course, is very cool, but the question immediately arises - at whose expense will this banquet be? I do not want to hint at anything, but here is a small list of what happened in the last week in the countries of South America:

- Coup in Peru

- The ongoing pre-coup in Brazil

- Agreement between the Central Bank of Argentina and China on reservations in yuan

- Military-political crisis in Mexico

I talked about the fact that Mexican drug cartels are returning to their roots and are increasingly using crypto in their dirty deeds in one of the previous issues. And here is the latest information with statistics around the world. The amount of crypto used for criminal purposes in 2022 reached a record $20.1 billion, according to RTRS.

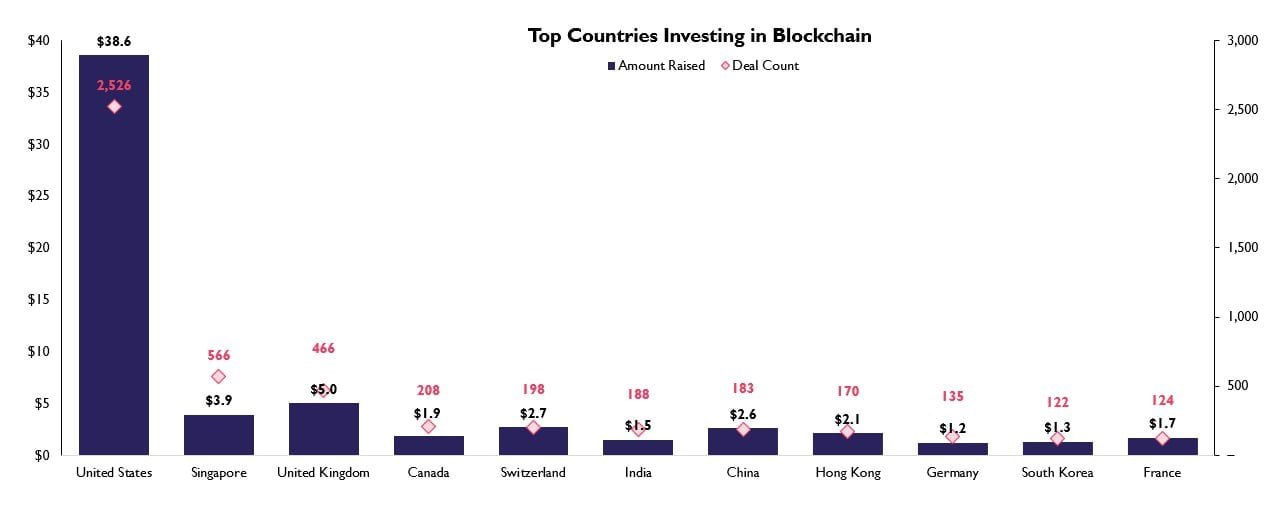

That being said, let's take a look at the countries that invest the most in blockchain:

It is not at all surprising that the news that the Fed does not intend to impede the development of the crypto industry looks like. A little more surprising is the fact that for almost 1.5 decades the most powerful intelligence in the world, the CIA, has been unsuccessfully “looking” for the founder of bitcoin, Satoshi Nakamoto, and cannot find him in any way. However, as it usually happens, the main thing in the search process is not to find yourself 😅

This week, exactly 14 years ago on January 11, 2009, the first BTC node was launched, programmer Hal Finney wrote about it on his Twitter account.

And already on January 12, 2009, the first transaction with BTC took place: SN sent 10 bitcoins to Hal. Bloomberg's chief ETF analyst Eric Balciunas believes that the transaction took place between the same person. By the way, at the dawn of the blockchain, Hal Finney predicted a rate of $10 million for one bitcoin in the future. Feeney died in 2014 at the age of 58, having been started by his wife last month.

Meanwhile, Twitter itself began testing digital coins that allow you to reward posts with various kinds of reactions, for example, “Bravo”, “Gem”, “Crown”, etc.

The option will be implemented using the Stripe payment system, which I talked about a lot in past issues.

So far, we are not seeing Twitter Coin, of course, but something similar is starting to emerge.

The Block company of Jack Dorsey (ex-head of Twitter) is developing its non-custodial crypto wallet. As we remember, Vitalik Buterin actively “promotes” them (more on him later).

Dorsey is also working on integrating the Lightning network into Square POS terminals, according to Bitcoin Magazine.

This week has been full of collaborations. Ava Labs partners with Amazon Web Services (AWS) to deliver scalable blockchain solutions for enterprises and governments.

Payment service CoinGate, in partnership with the Wix platform, launches a crypto payment service for retailers in Europe: Germany, Lithuania, the Netherlands and Spain.

By the way, if you touched on the topic of Europe. The French Société Générale has borrowed 7 million DAI stablecoins from MakerDAO secured by mortgage bonds. Somewhere, Michael Burry alone cried.

Shiba Inu is hinting at a partnership with Bugatti in the next few days, and payment giant Mastercard has partnered with Polygon to launch a Mastercard Artist Accelerator web3 program for emerging music artists.

Polygon itself will hold a hard fork on January 17 - an update of the PoS chain to improve performance. And Ethereum developers have confirmed plans to roll out the Shanghai update to the testnet in February, and to the mainnet in March. The hard fork will allow users to withdraw almost 16 million ETH from the deposit contract.

It is worth noting that the tokens of liquid staking protocols like Lido Finance, Ankr and Rocket Pool have significantly risen in price on this news.

By the way, METIS, the token of Vitalik's mother's project MetisDAO, has already made +20% since the beginning of the year.

And what does Ripple predict for the rest of 2023:

- the introduction of crypto among institutionals will accelerate

- a huge increase in tokenization volumes

- further introduction of stablecoins

- world central banks will continue to work on CBDC launches

- improved regulation

And since we were talking about Shanghai above, albeit within the framework of Ethereum, let's analyze each of these theses using the example of China.

The Hong Kong authorities have confirmed the course towards the development of the crypto industry - Financial Secretary Paul Chan announced the readiness of the jurisdiction to accept cryptocurrency companies from all over the world.

In accordance with the adopted rules, crypto companies are subject to the requirements that apply to the traditional financial sector. By the way, speaking about the traditional financial sector, Ray Dalio does not renounce his ideas. Bridgewater Fund doubled in Chinese assets in 2022 to over $2.93 billion and became the largest non-resident fund in Chinese markets.

Also, the Hong Kong government will issue tokenized "green" bonds.

In turn, DeFi firm Ondo Finance began tokenizing US government bonds. And El Salvador passed a bill providing the legal basis for issuing BTC-backed bonds, known as the “Volcano Bond”. They will be used to pay off sovereign debt and finance the construction of “Bitcoin City”.

By the way, El Salvador legalizes all cryptocurrencies in the country. The authorities approved the law on the release of digital assets and interaction with them on the territory of the state.

And if you are already a little tired - then it's time to take a breath. This is what El Salvador's Miss Universe contestant looks like.

We return to China, which, according to QryptoQuant, is returning to the cryptocurrency market. China's first BTC Futures ETF raised $79M in debut trading.

At the same time, Samsung Asset Management will launch the “Samsung Bitcoin Futures Active ETF” in Hong Kong. By the way, it is worth noting that Samsung is knocking not only on China. The company won a tender for the construction of a petrochemical plant in Qatar. The deal is estimated at almost $2.5 billion!

Confirming the following thesis from the forecast from Ripple, the Central Bank of China begins to include digital yuan in circulation in its data on the money supply M0 (cash).

Finally, the Hong Kong financial regulator will offer a list of tokens that can be traded by retail investors. The Hong Kong government promises not to stifle the crypto market much with regulation, hints at support in unlocking the potential of Web3, as well as support for businesses in integrating with digital assets.

The financial regulator of Thailand is launching a "Crypto Academy" for investors in digital assets. I talked about a similar project from India in the last issue. By the way, India and Sri Lanka will start trading in Indian rupees, according to The Economic Times, and according to SIAM, India overtook Japan for the first time and ranked third among the world's largest automotive markets after China and the United States.

Since we are talking about cars, I can not get past the next news. Afghanistan has unveiled its own Mada 9 supercar, which was created by the ENTOP design studio and the Afghanistan Vocational Institute.

Why it is called a supercar is difficult to say - because inside there is an engine from Toyota Corolla, and the body is a spatial frame to which composite external panels are attached. But you must admit - Batman would not pass by such a beauty.

In Japan itself, a strange patent from Sony appeared. In order for the content on the smart screen to continue after the advertisement, it is necessary to perform an action or say what the advertiser requires from the viewer.

Louis Vuitton went even further and placed a real android with the appearance of a Japanese artist in their store. It still looks creepy.

Meanwhile, during an AMA session on Reddit, Bill Gates was asked the question "Which of the emerging technologies has the growth potential comparable to the Internet boom?"

According to the billionaire, the next revolutionary technology could be artificial intelligence. At the same time, he believes that the potential of Web3 and the metaverse is greatly exaggerated.

But according to a review from McKinsey, by 2030, metaverse technologies can bring up to $ 5 trillion.

In order for the Metaverse to reach its full potential, devices (AR/VR, sensors, haptics and peripherals), interoperability and open standards, specialized platforms and development tools are needed.

Remember in one of the first issues I talked about a VR helmet filled with explosives? So, at the recent CES 2023, a VR headset was introduced that simulates pain from stab and gunshot wounds.

It is presented in the form of special clothes, through which electrical signals pass, simulating very painful injuries. Truly a brave new world!