Creation - 09. 2018

Token standard – ERC-20 Ethereum

Listing - https://coinmarketcap.com/ru/currencies/gemini-dollar/markets/

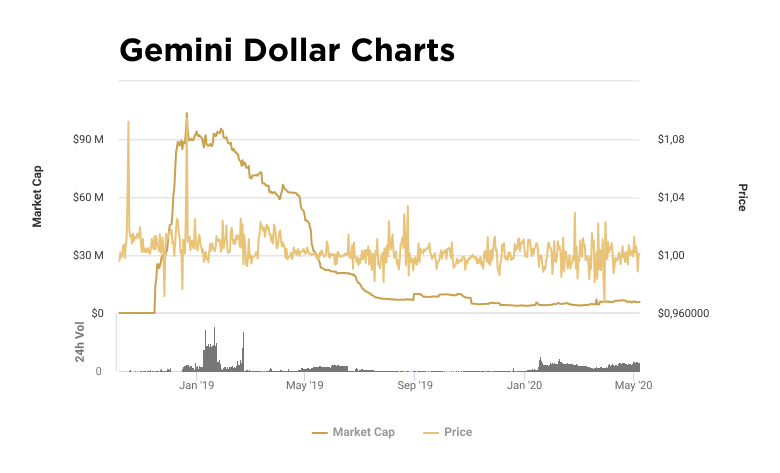

Market capitalization – $7 017 251 USD

Total emission – 6 993 825 GUSD

In circulation - 6 993 825 GUSD

Coinmarketcap rating- № 340

Maximal token price over the time - $1,19 USD

Minimal token price over the time - $0,852120 USD

Website of the project - https://gemini.com/dollar

Likedin - https://www.linkedin.com/company/gemini-com

Facebook - https://www.facebook.com/GeminiTrust/

Twitter - https://twitter.com/gemini

GUSD cruptocurrency review

Gemini Dollar –is a stablecoin, issued by the company Gemini Trust Company LLC and launched into circulation by the eponymous American crypto-exchange Gemini, under the initiative and control of its owners, - billionaire-brothers Cameron and Tyler Winklevoss.

The main concept, underlying the development of Gemini Dollar stablecoin, is creation and issuance of the digital analogue of US dollar (USD), which could be available for enablement of transactions on platforms that don’t accept fiat assets. Moreover this stablecoin was created as a tool for preservation of price of these very dollars. Stablecoin is secured by real US dollars and also is a digital equivalent of real currency reserve, deposited on the exchange in the ratio of 1:1 and stored in State Street Bank (where accounts are insured by FDIC) and Trust Company (regulated and verified New York trust company).

GUSD combines creditworthiness and price stability of US dollar with blockchain technology, while being under control of American regulators. Token is built on the standard ERC-20 of Ethereum blockchain. The rights belong to the eponymous exchange Gemini.

Audit if conducted on a monthly basis by an independent company BPM (Burr, Pilger, Mayer) Accounting and Consulting.

The aim of an auditor is to verify the compliance of quantity of tokens with the respective sum on the account. The results of every audit check are in the public access.

The code of smart contracts Gemini Dollar has passed audit “Trail of Bits, Inc.” performed by the company, involved in research and development in the field of information security, whose report is publicly accessible here.

As it has been already mentioned before, the new coins are created at the moment of their procurement on an exchange. If a client sells them or returns GUSD – they are “burned”, and money from the dollar account is given to the client. Buyout of tokens is carried out only on Gemini exchange.

GUSD token supports all the technical features of the standard ERC-20, and with its aid, one can create smart contracts and store the token in any existing Ethereum-wallet.

In exchange tenders (where fiat assets and pairs are not utilized), this stablecoin allows to increase the volume of tenders on account of its own equivalence to US dollar.

Gemini stablecoin has found its application on the platforms of various projects; it is used as a secured mean of payment and as an investment tool ( Traval.com, HARBOR, BTG Pactual, Latium, Flexa, BlockFi).

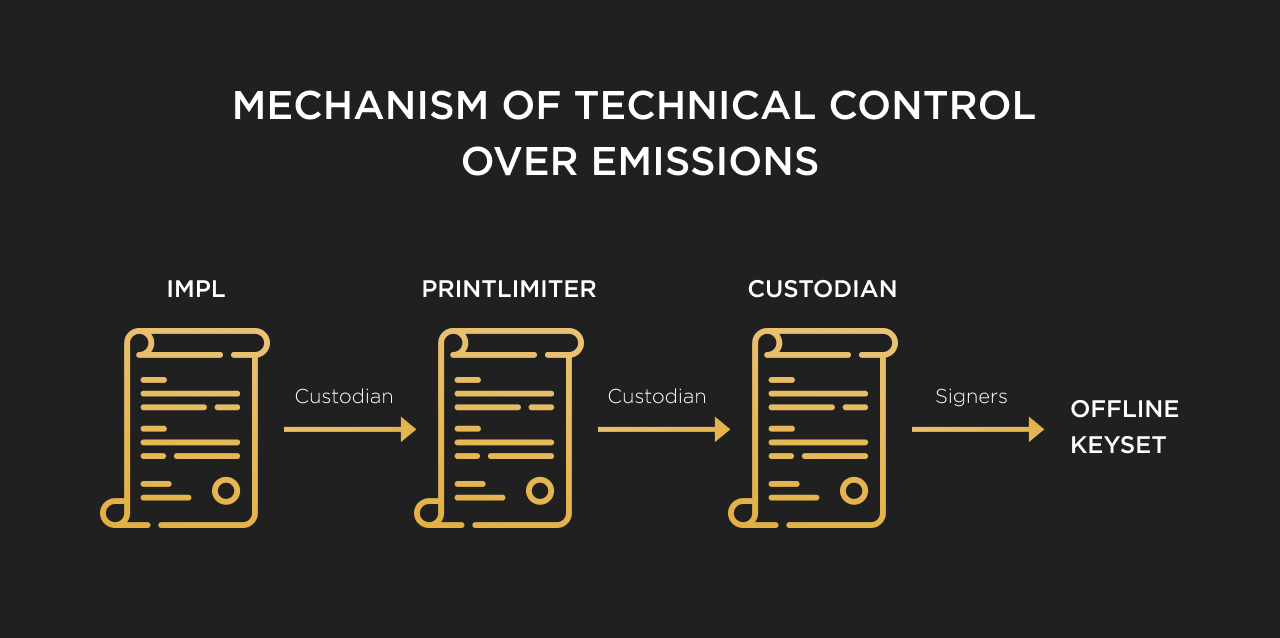

The token is supported by three levels of smart contracts:

- “Proxy” level ensures the emission of the token and transactions;

- “Impl” level includes all the data and the algorithm of creation, elimination and transfer of the token. Functions of smart contracts within this layer will work only if it’s allowed by “Proxy” level;

- “Store” level is a ledger, where the analysis and benchmarking of balances with their owners are performed, with consequent publication of the data on transactions with tokens for viewing on blockchain.

The present structuration creates agility and ensures complete decentralization and transparency of all the transactions.

Apart from that, GUSD protocol has a flexible limitation imbedded, guaranteeing that the number of tokens in circulation will never exceed the residual. This limiting function (PrintLimiter) of the protocol is maintained at the level “Impl”, and it creates strict limitation and control over the emission of GUSD tokens. Requests for expansion of the limit are to be approved by autonomous sets of keys. In other words, unregulated emission of tokens is not possible.

The main claim of critics of this coin is the fact that it is way too centralized and can anytime stop being supported by authors and developers of the token.

However, it needs to be noted, that such claims can be referred also to other stablecoin projects, that compete with GUSD but, the same way as GUSD, experience serious demand from users and capitalization.

Total token emission is equal to 6 993 825 GUSD.

Consequently, all the 6 993 825 GUSD are in circulation.

Market capitalization of the project amounts to $7 017 251 USD.

The highest market price of GUSD tokens was fixed on 16th of October, 2018 and amounted to $1,19 USD per token.

The lowest price of the token was observed on 12th of March, 2020 and was equal to $0,852120 USD per token.

GUSD token has passed listing on various exchange platforms, among which there are Inanomo , FatBTC, BitForex, HotBit, Exmo and is most often traded in the following pair combinations GUSD/USDT, GUSD/BTC, GUSD/ETH.