Last week, Ark Investment Management (Ark Invest) published its annual Big Ideas 2023 report. The report "highlights the technological breakthroughs that are happening today and creating the potential for super-exponential growth tomorrow," analysts at Ark Invest explained. Topics discussed in the report include artificial intelligence (AI), digital wallets, public blockchains, bitcoin, and smart contract networks.

I’ll try not to talk about AI, it’s on the hype without me. But I'll tell you about the crypto with pleasure. Specifically, about BTC. The nerds at Ark Invest provided three different bitcoin price predictions in this year's Big Ideas report, instead of the one suggested last year.

The bear market forecast suggests that BTC will be worth $258,500 by 2030, while the bull market forecast suggests that the price of the cryptocurrency will reach $1.48 million per coin. The firm has also offered a “base case” BTC price target of $682,800 using what it considers the most likely assumptions.

I note that analysts put forward such assumptions based on eight factors, among which, first of all: the volume of cryptocurrency in the wallets of institutional investors and the amount of transactions in digital assets.

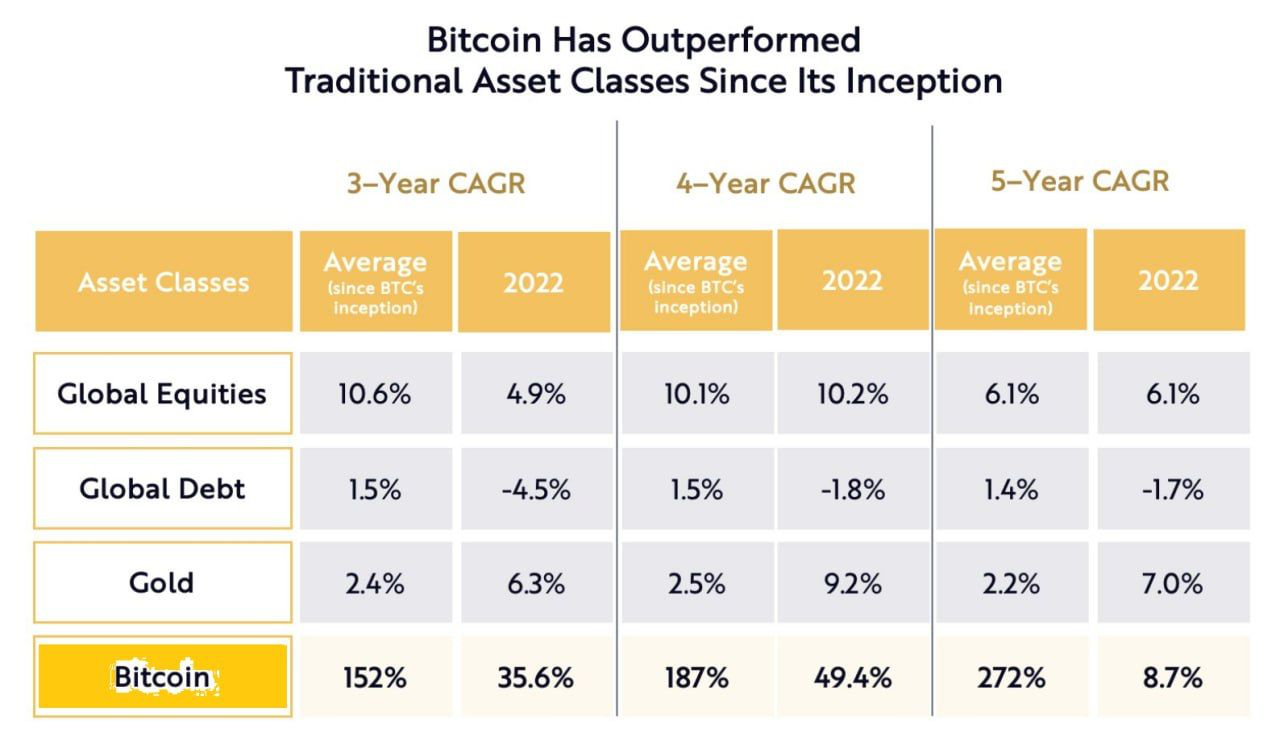

At the same time, Ark Invest noted that over the course of a little more than 13 years of its existence, bitcoin managed to survive 5 price drops by more than 75%, but is still ahead of stocks (global equities), bonds (global debt) and gold in terms of global growth.

In turn (already well known to us from past articles), Ray Dalio stated that what the crypto industry and BTC have done over the past 12 years has been “amazing”. However, BTC, in his opinion, is a tiny thing that attracts “disproportionate attention.”

Dalio noted that the value of bitcoin is, for example, less than a third of the value of Microsoft shares.

“Bitcoin is not an efficient store of wealth, a medium of exchange, or even efficient money.”

The billionaire investor believes that the economic crisis is a cycle and "Bitcoin is not the solution." He offers an alternative - coins pegged to inflation, it’s a pity without naming them 😅

Dalio emphasizes that bitcoin is "unfit" for this task. At the same time, the throughput of the Lightning Network layer 2 solution has grown by 300 BTC since the beginning of this year alone.

According to statistics from The Block portal, since the beginning of 2022, LN throughput has increased by 63%, from 3350 to 5490 BTC. In January alone, the indicator increased from 5100 to 5490 BTC.

And a few more calendar events related to growth. Exactly 12 years ago, Bitcoin became worth $1!

By the way, since we have already compared the global growth rate of BTC with stocks, bonds and gold, it would not be out of place to add the following entertaining information.

Global investors are losing interest in Chinese government bonds, RTRS reports.

And earlier, BBG showed that Chinese traders have been actively selling Hong Kong stocks since the beginning of February.

Parallel to these events, Bank of America is preparing for a possible default on US debt.

The bank's chief executive officer, Brian Moynihan, expressed hope that a default would not happen, but urged to prepare for the worst.

Congress is aware of this situation. Treasury Secretary Janet Yellen announced such a gloomy prospect.

India, meanwhile, ranked fifth in the world in gold and foreign exchange reserves, with reserves reaching $563 billion. Russia ended the year in fourth place with $582 billion. Switzerland was third with assets of $924 billion. Japan was second with $1.27 trillion. The leader was, of course, China, whose reserves amounted to $3.31 trillion.

Let's talk briefly about each of the countries. Algorand is the first Layer 1 blockchain protocol to partner with T-Hub, India's premier innovation hub with 600+ enterprise partners including Intel, AWS, Boeing, Meta, Microsoft, Cisco, and more. This partnership will support startups and existing companies that create highly efficient and scalable blockchain-based solutions.

In Russia, Sberbank expects to launch a decentralized finance (DeFi) platform by May of this year, and the stage of its open testing will begin in March, said Konstantin Klimenko, Sberbank Blockchain Laboratory Product Director.

Also Russia is going to build a cryptocurrency hub in Abkhazia. The republic is already creating a legislative framework for this.

Swiss Credit Suisse posted an annual loss of $7 billion. This is the worst result since 2008. At the same time, the Swiss “crypto valley” in Zug, flowing into Liechtenstein, gave the country an advantage in the development of digital assets and related technologies using blockchain.

The Prime Minister of Japan this week came out with support for the NFT, DAO, Web3 and any blockchain initiatives.

China will pay in national currencies with the BRICS, taking into account the needs of companies, according to the Ministry of Commerce of the PRC.

In turn, Nouriel Roubini, whom I spoke about a few articles ago, again listed the problems of the dollar as a reserve currency, but recalled that there is no alternative yet, since Beijing controls the yuan too much.

An interesting fact is that the Chinese spent the subsidies allocated by the state in 9 seconds, writes Global Times. Chinese cities have given away 180 million digital yuan (about $26.5 million) in subsidies and coupons to encourage the use of digital currency on Chinese New Year.

Meanwhile, Rosbank, together with the Atomize platform, successfully tested the purchase of a digital financial asset (DFA) for gold for digital rubles using the blockchain!

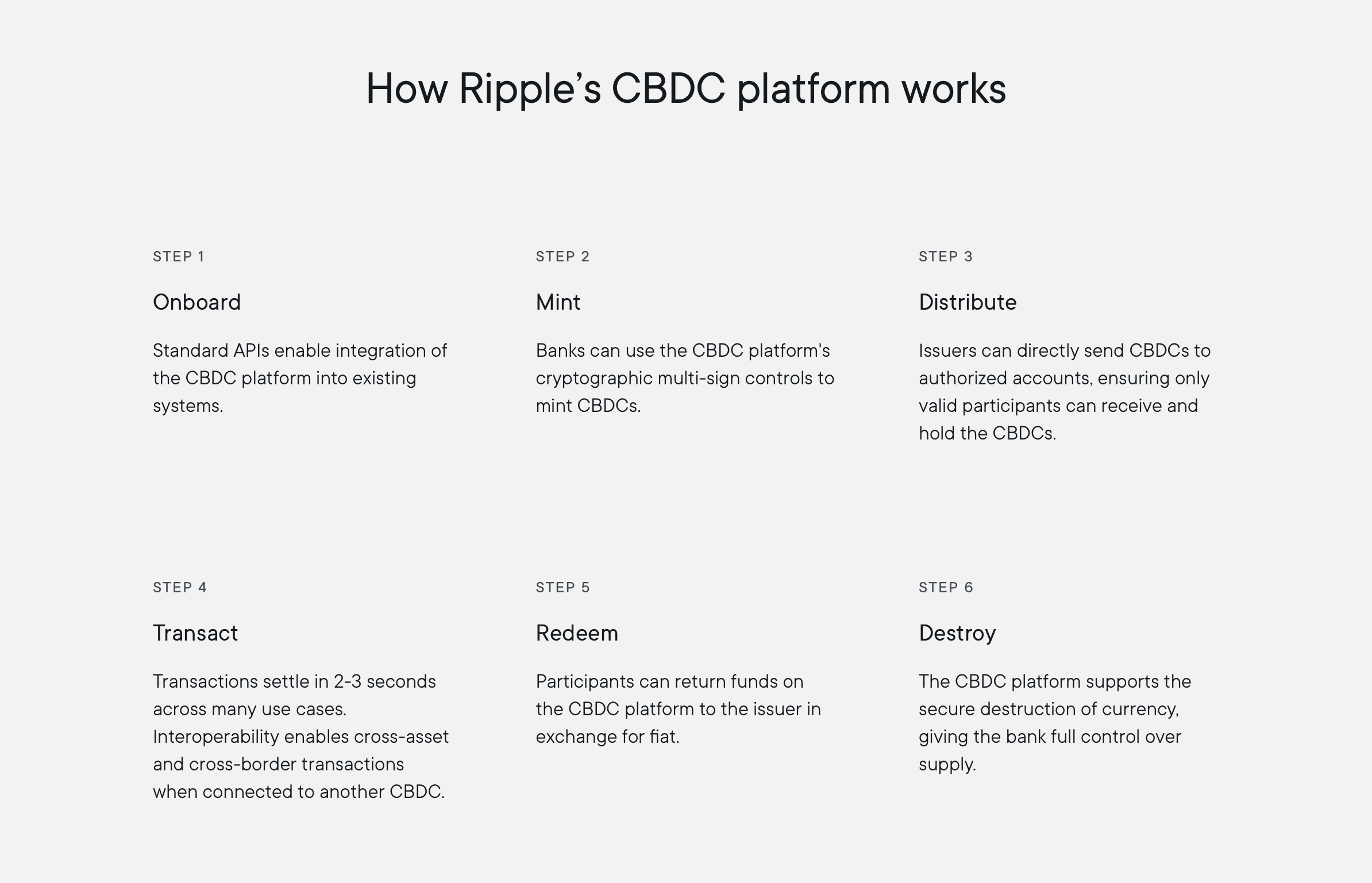

And the Ripple company began to look for a blockchain specialist who will be responsible for working on projects related to CBDC. As we remember from previous releases, the company already has several agreements with central banks.

By the way, perhaps not everyone remembers, but the Ripple protocol was written by Canadian programmer Ryan Fugger in 2004, even before the advent of BTC!

The system was created as a new method of payments via the Internet.

In 2012, on the basis of this platform, the development of a payment system called the Ripple Transaction Protocol (RTXP) began. It provided instant and direct money transfer between two parties with low transaction fees.

In turn, Deutsche Bank is ready to double the rate on crypto and other digital assets. The bank will take advantage of the downturn in the crypto sector for "interesting opportunities". DWS, the bank's asset management arm, plans to invest in crypto projects, according to BBG.

And Visa's cryptocurrency strategy is aimed at settlements in stablecoins, said the head of the company's crypto division, Kew Sheffield. BIS announces that it is working on a stablecoin balance monitoring system!

Meanwhile, Finnish company Membrane Finance has announced the launch of a FIN FSA-regulated EUROe Ethereum-based stablecoin with a 1:1 peg to the euro.

According to the announcement, EUROe is the result of two years of work and further integration is planned in Solana, Polygon and Arbitrum One networks. The company has also raised €2 million to develop a bridge and a tokenization platform that will launch in 2023.

At the same time, the Finnish Nokia is starting to use the metaverses in business! The innovation will allow isolated airports from different parts of the world to interact, connect and train their aircraft technicians.

Wallmart is not far behind and applies for trademarks related to crypto, metaverses and NFTs. eBay is also hiring employees in the Web3 direction after the acquisition of the NFT marketplace.

At one time, Mike Novogratz, who recently increased investment in bitcoin mining again, argued that everything is just beginning in NFT. And that in 10 years the industry will be much larger than expected.

Every industry will use this technology to create and grow their communities and profit accordingly. It's just a matter of time. And judging by the news of the past week - I will not undertake to argue with him.

I have already announced a couple of news above, but here are a few more for you. The VKontakte NFT transfer service has started working with TON! Louis Vuitton and renowned Japanese artist Yayoi Kusama will release the NFT collection.

Backed by a16z and Steve Aoki, Arpeggi Labs, a Web3 music studio, is raising $11 million in a second investment round. The startup offers a browser-based sequencer for creating music with further processing of works in the form of NFTs.

In turn, the NEAR Foundation (no, I will not talk about AI in this article 😬) enters into a partnership with New York University. Together, the companies will launch an educational program on Web3.

By the way, in the end I will ask you a riddle. In what area do you think the Finns from Nokia have tested their interest in the metaverse? Yep 😉🍻

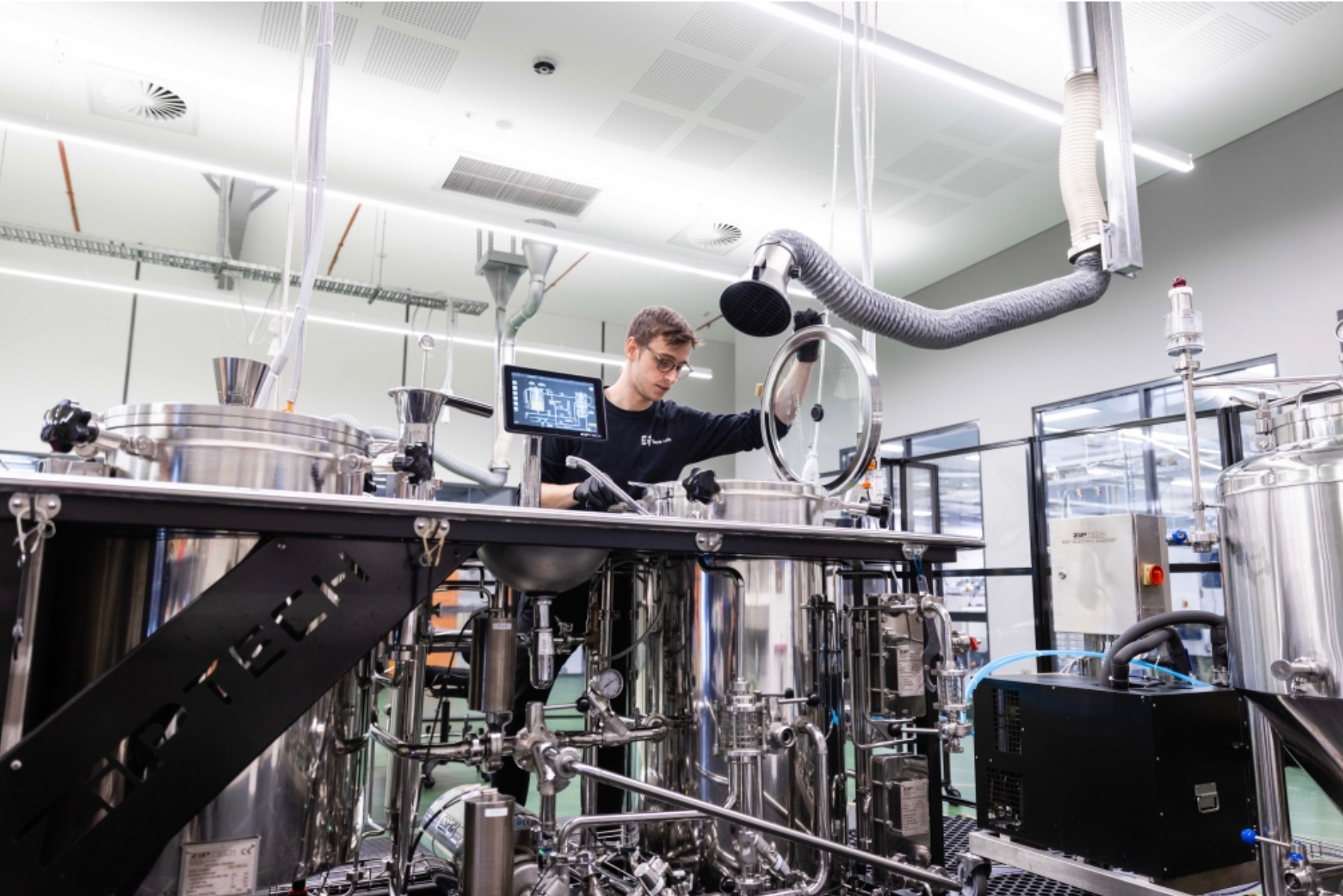

According to Robert Joyce (not actually from the Finnish division, but a technical director from Oceania), Nokia is integrating rapidly evolving blockchain technology to allow remote breweries to connect with their workers and share industrial ideas in the metaverse.

Joyce said Nokia teamed up with an Australian university last year to create 5G-enabled microbreweries that use the metaverse. The metaverse brought together researchers from the brewery's technical laboratory and the University of Dortmund in Germany. He explained:

“They do collaborative experiments where they brew beer, change the process, temperature, time, volumes, recipes […] and transfer this whole brewing process to a digital twin. Then they simulate the brewing process in this digital twin to perfect the beer in the digital space.”

He believes that by next year, the "industrial metaverse" will have five times more revenue than the consumer or corporate one.

Joyce doesn't expect the "consumer metaverse" to take off until 2030. And there, may be, bitcoin will reach the forecasts of Ark Invest 😅