On December 30, 2022, a new issue of the German magazine Spiegel was released with a provocative headline:

«Was Marx right in the end? Why capitalism doesn't work anymore - and how it can be upgraded».

The authors note two interesting facts. Firstly, that the 4th year of Covid has already begun (!), and secondly, that even the very capitalists who made fortunes on these very crises, such as Ray Dalio, are starting to scream about the crisis of capitalism. And what if you do not urgently slow down - it will become more and more difficult to “make fortune” further.

And in corporations from Bosch to Goldman Sachs, there is a debate about finally putting the social interest ahead of the interests of shareholders.

The author of the article cites the ideas of the Japanese publicist Saito, who at the end of 2020 wrote a book about new eco-socialism.

He interpreted the climate crisis as a "manifestation of capitalist production" in the spirit of Marx. The collapse of the planet can only be stopped by a post-capitalist system in which there will no longer be growth, social production will slow down, and wealth will be redistributed purposefully.

What to read? On the topic outlined by the German magazine, I strongly advise you to read the book “Why Marx Was Right” by Terry Eagleton.

Also Robert Reich's “The System: Who Rigged It, How We Fix It”.

But back to Japan. So far, they are not thinking seriously to slow down.

The head of the Central Bank said that the easing of the monetary policy will continue.

In turn, Panasonic Holdings plans to invest more than 50 billion yen ($375 million) over three years to expand production in China, betting on the country's long-term potential due to coronavirus easing.

As online shopping has become popular in China, Panasonic will make more products available online. The goal is to have at least 7 million registered users on the official e-commerce platform by fiscal year 2024, up from around 2 million currently.

Canon's Kokomo smartphone app is timely released. IT creates 3D images of users who can interact in a virtual space (just imagine how convenient it will be to “shop”).

The South Korean giants are also not far behind. LG Electronics plans to expand its TVs' compatibility with the Metaverse, and Samsung has partnered with streaming app Savage (on Polygon) - TVs will now support super high quality pictures and videos for Web3 users

Kokomo users will need a VR headset to "enjoy an immersive experience." The first countries that will be able to test the novelty will be Canada and the United States.

Meanwhile, on January 30, CME will launch three metaverse indexes for Axie Infinity, Chiliz, and Decentraland. And BlackRock began to add BTC to its Global Allocation Fund for passive investors (as we remember, only 0.32% of the BlackRock investment fund is enough to buy all BTC reserves on exchanges).

At the same time, the US and Japan this week agreed to cooperate in the field of semiconductors. The Nikkei also reports that the market is in a strange situation with a temporary chip glut that is forecast to last through most of 2023.

Inventories of chips and other semiconductors rose amid a downturn in the tech sector.

In turn, the Zimbabwean government banned the export of lithium. The government said it was losing 1.7 billion euros due to its export as a raw material, not processing. In two years, the price of lithium has increased by 1100%.

The move is very timely. After all, the list of countries with the highest risk of default includes a lot of Zimbabwe's neighbors.

Let's briefly go from top to bottom. Back in November, the El Salvadorian government proposed a draft “law on the issuance of digital assets” in the country. Recall that bitcoin in El Salvador is recognized as legal tender.

Ghana plans to buy oil with gold instead of US dollars.

The Central Bank of Tunisia is exploring the possibilities of the digital economy and, in particular, issuing its own digital currency.

The launch of CBDC in Pakistan is planned by 2025, the Central Bank of the country announced in December last year. The Egyptian pound set a new anti-record against the USD this week, however, it is interesting that Egypt plans to start mining uranium in 2024.

I talked about electric bikes from Kenya in a previous article, as well as about fan tokens from the Argentina national team (well, a little about 100% inflation).

Meanwhile, Ukrainian pharmacies were the first in Europe to accept Binance Pay. In Bahrain, this system is already being used in supermarkets with might and main. And in Namibia, the University of Namibia (UNAM) introduces courses on blockchain and crypto!

Incidentally, the Government of India is also launching a campaign to raise awareness about cryptocurrencies. This is not surprising - I spoke about the fact that most of the adult population of this country uses cryptocurrencies in the last article. It is also believed that India will become the most populated country in the world, overtaking China. According to UN calculations, this will happen as early as April this year.

I also talked a lot about Brazil before, we will skip it. Much has been said about Nigeria. The EU intends to cooperate with it in the energy sector. Just like with Angola and Senegal - to reduce their dependence on Russian gas imports.

The Central Bank of Rwanda is also keeping up with its neighbors and is exploring the possibility of issuing its own digital currency. In South Africa, the second largest Pick'n'Pay supermarket starts accepting BTC. Payments are processed using the Lightning network (which we will talk about later).

In Costa Rica, a power plant, after a downtime due to a pandemic, went into crypto mining. The Central African Republic started the public sale of its Sango Coin back in July.

Tunes, a global cross-border payment company, has entered into a strategic partnership with one of the largest banks in Morocco. Thunes is connected to Attijariwafa Bank via Ripple.

It is worth noting that Ripple ODL is currently used in 40 markets which account for about 90% of the FX market. The total volume of payments and transfers in RippleNet exceeds $15 billion, and the global volume of ODL has grown 9 times y/y. In addition to Africa, Ripple is also betting on Asia and the East.

Ecuador has finally reached an agreement to restructure its debt with Chinese banks. And the Central Bank of Turkey announced the completion of the first phase of testing the national digital currency.

It also became known that Turkey plans to use blockchain technology to identify users when entering public online services.

In China, Hong Kong brokers and fund managers are gearing up to trade digital assets as the regulator expands the access of physicists to crypto trading. And, as I have said many times before, crypto markets have high hopes for Hong Kong.

Also, Hong Kong legislators have suggested that the digital Hong Kong dollar could be converted into a stablecoin to be issued by the government and connected to DeFi. Hong Kong is actively developing Web3 with the permission of China.

Meanwhile, China's willingness to move to buying oil from the Gulf countries in yuan is leading to the formation of a new global energy order, according to the FT.

As I said earlier, many experts agree that buying oil and gas with yuan is a move that could jeopardize the dollar's global dominance in the long run.

"Russia and China have ended the era of US economic sanctions," reports Foreign Affairs.

As an example, three of the most “convincing” responses of the Russian Federation and China to the US sanctions policy are given:

- the creation of bilateral currency swaps that allow Moscow and Beijing not to use the dollar;

- development of non-Western payment systems similar to the Chinese alternative to SWIFT CIPS, which has already been joined by more than 1,300 banks from more than 100 countries;

- introduction of digital currency

By the way, about payment systems. The official website reports that by November 2023, SWIFT plans to significantly upgrade its system to support digital asset transactions!

Indonesia, in turn, encourages investors from Russia to participate in the construction of the capital. Indonesia is looking for solutions to problems with logistics for exports to the Russian Federation.

Also this week, it became known that Indonesia will create its own crypto exchange.

The Israeli financial regulator is proposing to include cryptocurrencies in the securities law, and Britain is introducing tax incentives for cryptocurrencies for foreigners using local brokers. The measures are part of the government's plans to turn the country into a crypto hub (which I detailed in the first digest).

Meanwhile, Qualcomm and satellite company Iridium Communications are rolling out technology that will allow smartphone users to send and receive messages via satellite when regular cellular coverage is unavailable.

And Cryptosat (also a Californian manufacturer of satellites) that power crypto and blockchain applications has partnered with SpaceX to send another satellite called Crypto2 into orbit.

Interesting forecasts for this year were given by VanEck. I agree with almost all theses, so I will share them with you:

- tokenization of traditional assets will gain momentum;

- Brazil will become one of the most cryptocurrency-friendly countries in the world and tokenize part of its sovereign debt on the blockchain;

- Twitter will receive state licenses for payments, directly competing with Venmo and Cash App

- one of the countries (most likely one of the oil exporters), will announce the addition of BTC and other digital assets to its sovereign wealth fund

- a new decentralized stablecoin with a market cap of $1 billion will appear;

- Ripple will lose the SEC lawsuit;

- Gary Gensler to leave SEC;

- ETH will trigger withdrawals from the Beacon Chain network;

- the Web3 gaming industry will grow dramatically.

Confirming predictions, developer PlayerUnknown's Battlegrounds (PUBG) has partnered with web3 platform Banger to bring NFTs to multiplayer. Integration is scheduled for 2023.

The Dogecoin Foundation has announced the creation of a new development fund. With a real dog, by the way, so far so good.

The first crypto ATM with Lightning network support is installed in Australia. And Michael Saylor revealed details about the Lightning Network-based solutions that MicroStrategy, which he founded, is developing for release in 2023.

Among them is software that will reward users for writing reviews or participating in surveys in satoshi. The founder of MicroStrategy said that the company is interested in creating solutions that allow any enterprise to "deploy" the infrastructure necessary for interacting with the Lightning Network "in half a day."

The man with two dads, Robert Kiyosaki, says he keeps buying bitcoin. Believes that BTC is classified as a commodity, like gold or silver, and most other tokens are classified as securities, and regulators will destroy them.

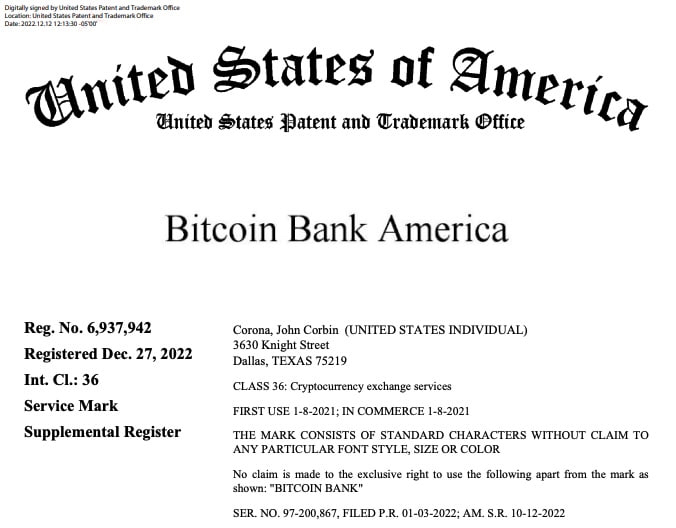

Let's finish the issue with the fact that on December 27, 2022 in Dallas, a certain John Corbin registered the trademark "Bitcoin Bank America". Bitcoin Bank, Carl!