A terrible thing happened! Snickers maker fined $14,500 after workers fall into a vat of chocolate, according to the US Occupational Safety and Health Administration.

The situation itself, to be honest, is ridiculous, but the scary thing about it is that all this fine will not be enough for an NFT brick issued on the Bitcoin blockchain.

Here is such a handsome brick was purchased for 18.5 thousand bucks. Yes, yes, you heard right. The NFT wave has reached the "grandfather". The developers of the Ordinals project figured out how to create NFTs on the BTC blockchain, and a market is already forming around the new trend.

By the weekend of this week, the number of such unique tokens exceeded 116,000 units, says Dune Analytics. The average BTC block size has hit an all-time high since the launch of the Ordinals protocol, indicating heightened interest in the BTC network, according to CNBC.

In turn, analyst Willy Wu provided updated data on the adoption of bitcoin:

“The first cryptocurrency took 6 months to get 1000 users and 5 years for 1 million.

Today, 13.8 years since its inception, Bitcoin has over 300 million users (4% of the population).

At the current growth rate, in the next 3 years, the figure will reach 1 billion, or 12% of the world's population."

2 news from El Salvador simultaneously both confirm the opinion about the trend for the adoption of BTC and refute it. The state opens its BTC embassy in Texas, while the IMF opposes trading in El Salvador's BTC bonds.

Meanwhile, the popularity of the Ordinals protocol has also had a positive effect on the amount of fees per block, which means that we can expect some increase in miner income.

At the same time, the police of Abkhazia this week confiscated nearly 400 cryptocurrency mining rigs. Desperate miners mined the crypt in the most unexpected places - in a former military sanatorium, at a concrete plant, in a parking lot and in the Sukhumi Palace of Culture.

By the way, a couple of days before that, information appeared that Russia was going to build a cryptocurrency hub in Abkhazia. The republic is already creating a legislative framework for this.

This week was generally rich in krypton news from the Russian Federation. The Central Bank, together with 13 banks, will launch a pilot project on operations with the digital ruble from April 1. By the way, Japan will also launch a test version of CBDC in April.

Brazil is a bit ahead and is already running a digital realm pilot project. And in parallel, Binance launched a Visa debit card there. Meanwhile, Visa itself is partnering with crypto payments firm Wirex to expand the partnership to 40 countries!

In turn, Mastercard, in partnership with bit2me, launched a new debit card in Spain with a cashback in crypto.

The Central Bank of the UAE also announces plans to issue a national digital currency to stimulate cross-border and domestic digital payments. At the same time, a program plan for the transformation of the financial system infrastructure (FIT program) has already been released, taking into account the introduction of cryptocurrencies.

We return to Russia. The State Duma adopted in the first reading a bill according to which the operator of a financial marketplace will be able to combine its work with the activities of a blockchain platform that issues or exchanges digital financial assets.

Also, 4 more companies submitted applications to the Bank of Russia for registration as operators of information systems for the issuance of digital financial assets.

Meanwhile, MetaMask announced a partnership with the Mercuryo payment network. The integration will make it easier to purchase 18 digital assets with 19 fiat currencies using bank cards, Apple Pay and Google Pay. It is worth noting that the purchase of assets in the amount of up to €699 is possible without the KYC procedure!

In turn, Credit Suisse entered into a partnership with Taurus, an EU-regulated digital asset infrastructure provider. At the same time, information appeared this week that the European Commission is launching a regulatory sandbox for 20 blockchain projects annually until 2026.

The EU is also discussing the use of zero-knowledge proofs for digital IDs. I remember that I threatened to talk about ZK protocols in detail, but for now, let's just define the concepts:

In cryptography, a zero-knowledge proof or zero-knowledge protocol is a method by which one party (the prover) can prove to another party (the verifier) that a given statement is true while the prover avoids conveying any additional information apart from the fact that the statement is indeed true

In its roadmap for 2023, BNB Chain aims to double the speed of transactions. The goal is to actively implement ZK protocols, which will probably help increase the number of validators to 100.

And Polygon has chosen March 27 as the launch date for its zero-knowledge beta mainnet Ethereum Virtual Machine (zkEVM).

The Polygon co-founder believes that this solution will allow ETH to outperform Visa in terms of transaction throughput.

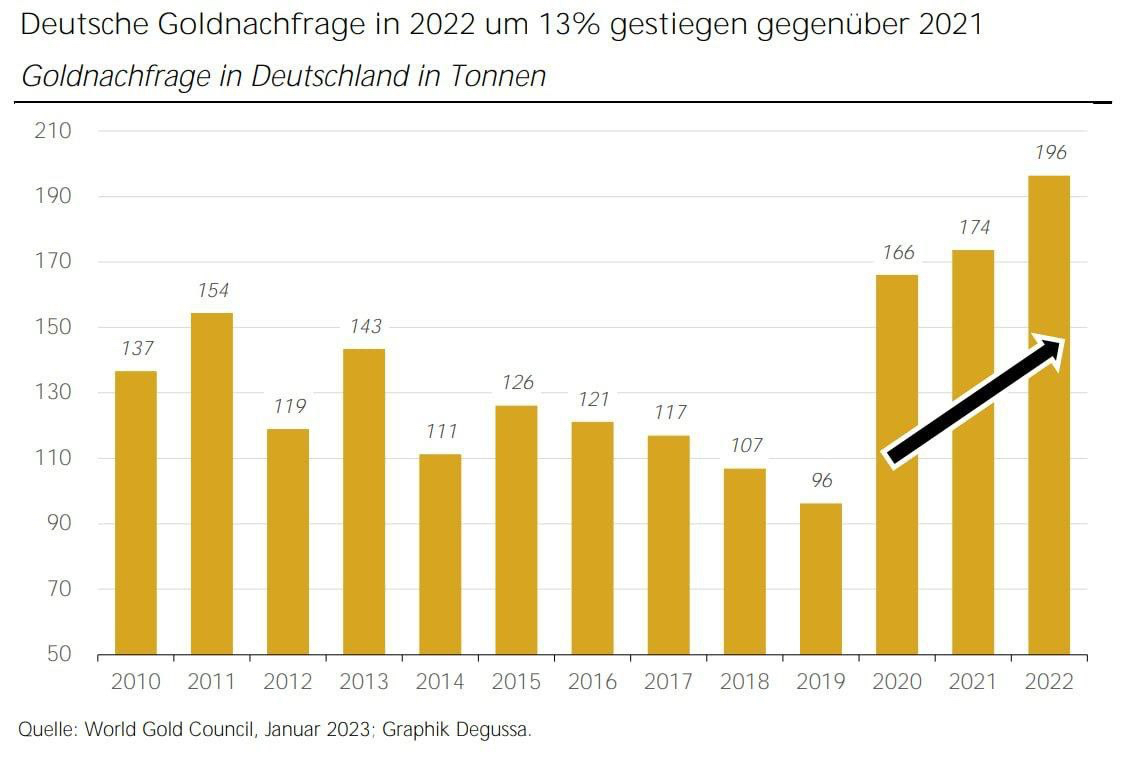

Also, the first digital bond of the German Siemens was issued on the Polygon blockchain. At the same time, the Germans themselves began to actively invest in gold.

Let's go back to Russia. The Central Bank of the Russian Federation allows the use of a digital token backed by gold in international settlements, said the first deputy chairman of the Central Bank, Chistyukhin.

At the same time, Russia and Iran are working on the "de-dollarization" of their trade and should move further in this direction, the Iranian ambassador said. Let me remind you the words of Alexander Brazhnikov, Executive Director of the Russian Association of the Crypto Industry and Blockchain, that the Central Bank of Iran is considering the possibility of creating a stablecoin together with Russia. The token can be used for the first time this year, when the special economic zone in Astrakhan will begin to accept cargo from Iran.

The Iranian parliament also approved a draft memorandum on joining the SCO.

At the same time, Secretary General Xi said that China is ready to deepen cooperation with Iran in trade, agriculture and infrastructure.

This week it became known that China will launch a national blockchain research center. And China Telecom, the 2nd largest wireless carrier in China (390+ million mobile subscribers), has partnered with Conflux to develop blockchain-enabled SIM cards.

3 great news from Hong Kong at once (let me remind you that Hong Kong is currently an "experimental" zone for the implementation of the crypt):

- Singapore's largest bank DBS will apply for a license to provide crypto services in Hong Kong

- The Hong Kong government is the first in the world to issue a batch of tokenized green bonds.

- On June 1, 2023, Hong Kong will officially make crypto trading completely legal for all its citizens.

But for contrast, news from Taiwan. The Ministry of Justice has included crypto exchanges and firms in the area of money laundering prevention and is actively preparing to include cryptocurrencies as assets that officials will have to declare.

Meanwhile, Bridgewater Associates hedge fund founder Ray Dalio continues to sing the old song:

China comes out on top in a trade war with the US, America is still on the verge of a military conflict with China, but domestic problems in the US pose a much greater threat.

At the same time, here is the opinion of Fed Governor Waller:

- banks working with crypto-currency clients must comply with KYC and anti-money laundering regulations;

- so far, the impact of the crypto industry on the US financial system is minimal. It is critical to mitigate the financial stability risks associated with crypto assets;

- CBDCs may make sense in some countries, but not in the US, "I'm not a big fan of the digital dollar";

- buyers of cryptoassets should not be surprised that the value of crypto could drop to zero, nor should they expect taxpayers to cover the losses.

Meanwhile, the G20 are exploring coordinated regulation of cryptocurrencies, according to India's finance minister. And the government of Rwanda ordered banks to stop operations related to crypto-transactions.

The British regulator will take action against unregistered illegal cryptomats. By the way, I advise everyone to refresh their memory of the very first issues of the Digest under the hashtag #Telegraphomania. Here and Here it is very interesting about the "Indian" Prime Minister of Britain and about their NFT-ATMs.

But back to the USA. The SEC has declared LUNA and UST securities and filed charges against Terraform Labs and its founder, Do Kwon. He is accused of organizing the largest fraud with securities, crypto assets, due to which investors lost over $40 billion.

Also, banks stop cooperating with crypto firms due to fears of reprisals from regulators. The latter threaten to separate digital assets from the traditional financial system.

Supervisors have raised concerns about such relationships since the collapse of FTX. According to the sources of the publication, against the backdrop of the SEC campaign against major players in the industry, the banking sector is thinking about limiting business with customers who may be under the gun of the Commission.

And here we come to the meat of this week's events. And, of course, we will talk about stablecoins.

Stablecoins play a vital role in crypto trading and their products have the potential to compete with the fiat banking system.

US regulators have begun restricting stablecoin products, but issuing stablecoins is important for crypto traders. The drop in stablecoin market capitalization is a sign of falling liquidity and leverage in the crypto markets, which is equivalent to quantitative tightening for the crypto market.

Morgan Stanley.

So, it all started with the fact that Circle (USDC issuer) filed a complaint with the New York State Department of Financial Services (NYDFS) regarding the quality of Binance stablecoin (BUSD) reserve management.

Further, PayPal suspended work on its stablecoin amid the activation of regulators and the beginning of an investigation against Paxos, the issuer of BUSD and its partner in the project.

At the same time, about $800 million was withdrawn from Binance just a day on the day when this news appeared. In addition, the buzz around BUSD worked in a classic way at the moment - Bitcoin fell to $21,500, Ethereum went below $1,500.

In turn, tokens related to protocols related to decentralized stablecoins (CRV, LQTY), on the contrary, showed growth.

Well, Tether, without hesitation, immediately printed 2 billion USDT!

Also this week, it became known that the share of USDT on Ethereum exceeded 51% in the stablecoin market.

Meanwhile, Tether is clearly not worth relaxing. Last week, two articles in the WSJ and Forbes continued to slowly reduce the company's reputation.

The WSJ reported that the creators are clearly not competent, indicating their past professions that are not related to fintech.

And Forbes is once again hinting at Tether's opacity and trust issue.

As a result, all hope is now on Coinbase, whose team is trying to convince regulators that stablecoins are not securities.

Another interesting news from America, Europe and Oceania. According to the CoinKickoff report, it is Western countries that are most resistant to the introduction of the metaverse. Among them are Denmark, New Zealand, the USA and Canada.

Among Americans, Florida residents show the greatest interest in the topic - 670 search queries per 1,000 people.

At the same time, Vietnam, the Philippines and Ukraine are leading among the countries that approve the concept of meta-worlds.

Also this week it became known that Microsoft will abandon its project to develop the industrial metaverse. Let me remind you that Nvidia is engaged in them.

At the same time, Elon Musk believes that the sensational search engine Microsoft Bing based on ChatGPT (by the way, from OpenAI - whose creator was Musk himself) is unsafe and should be closed.

However, such serious statements do not prevent the Emperor of Mars from joking. He recently posted a photo of his dog, Floki, in his chair as head of Twitter. "Dog" coins naturally reacted with rapid growth. FLOKI has already made +700% since the beginning of the year, and DOGE has risen by 30%.

Well, if the article began with a chocolate bar, we’ll finish on goodies. Twitter will be the first social network to allow cannabis ads in the US. Looking forward to collab with Snickers.